COLUMBUS, Ohio — The money was gone after a text message led to a phony phone call.

“They asked him if he had authorized a wire transfer and he replied, 'no',” said Jeff Phipps. “They kept him on the phone for an hour and 47 minutes. They said, ‘Well, we want to deactivate your account. Can you send us your username and your passcode?’ And he did thinking it was Chase.”

Phipps’ son thought he was talking to the fraud department at JPMorgan Chase when in reality, it was a sophisticated scam. When he responded to the text, they called from a number that was imitating Chase’s Fraud & Security team.

“The next day, my wife and he went to the bank, closed the accounts, and opened up new accounts with new passwords and user IDs. Then the next day, the same guy tried to do another wire transfer on the new accounts and their fraud department caught that one and refused it and rejected it.”

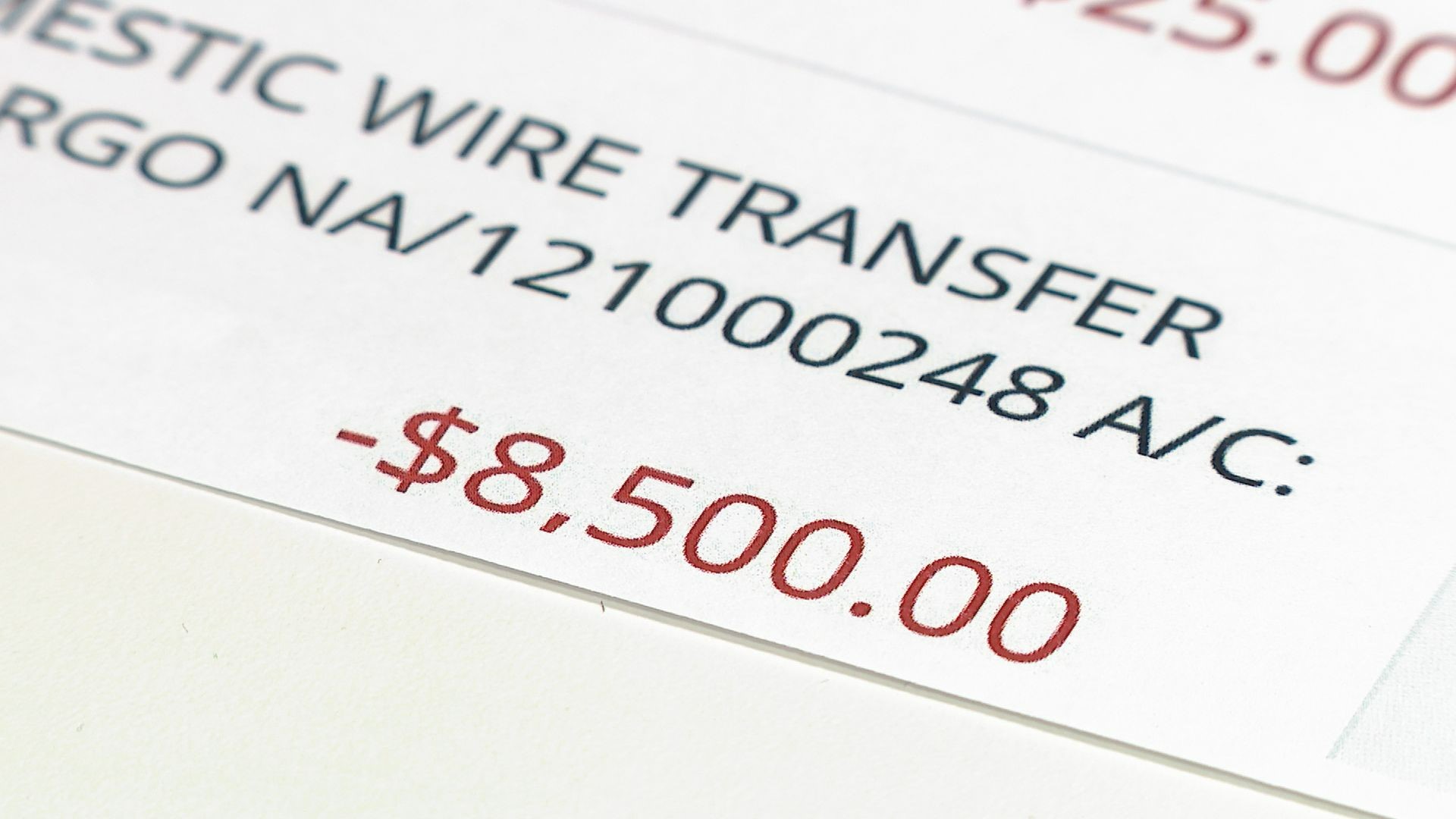

Phipps said they asked Chase to do a swift recall of the funds, but it wasn’t performed until weeks after the transfer. In all, $8,500 was lost in this scam.

“For him, it'll be, I don't know, probably a quarter to a half of the year to get that money back,” Phipps said.

Consumer 10 brought his wire fraud case to Chase. Their consumer protection division concluded too much personal information, including usernames, passwords and a one-time passcode, was surrendered and it did not qualify for a reimbursement.

A spokesperson issued this statement in response to the case:

"Scams are a societal problem. Scammers impersonate companies, banks and even government agencies to try to trick consumers out of their hard-earned money. We urge all consumers to ignore phone or internet requests for money or access to their computers or bank accounts. Legitimate companies won't make these requests, but scammers will."

“If you are the victim of a scam, you are a victim of a fraud,” said Lee Ann Lanigan, an investigator at the Better Business Bureau of Central Ohio. “These are unsolicited calls and texts. You didn't ask for them. Always feel free to hang up.”

Lanigan said impersonation scams are one of the top scams in 2022. She thinks these scams will be even more sophisticated in 2023.

Phipps came forward with his son’s story to prevent others from falling for the same scam.

JPMorgan Chase also sent Consumer 10 advice on how to avoid similar scams:

- Consumers should protect their personal account information, passwords and one-time passcodes.

- Never click on suspicious links or grant anyone remote access to your phone or computer

- Banks will never call, text or email asking for you to send money to yourself or anyone else to prevent fraud.

- If you want to be sure you’re talking to a legitimate representative of the company that contacted you, call the number on their official website.

- If you want to be sure you are talking to a legitimate representative of your bank call the number on the back of your card or visit a branch

- To learn more about common scams and ways to protect yourself visit: www.chase.com/security-tips