TOLEDO, Ohio — Editor's note: This story has been updated to show when defendants are due back in court for arraignment and which ones have had bonds set.

Eight financial managers from Northwest Capital, a Lucas County investment firm, are facing a combined total of 204 felony charges after allegedly mismanaging $72 million of client money and deceiving and defrauding investors in a decade-long scheme.

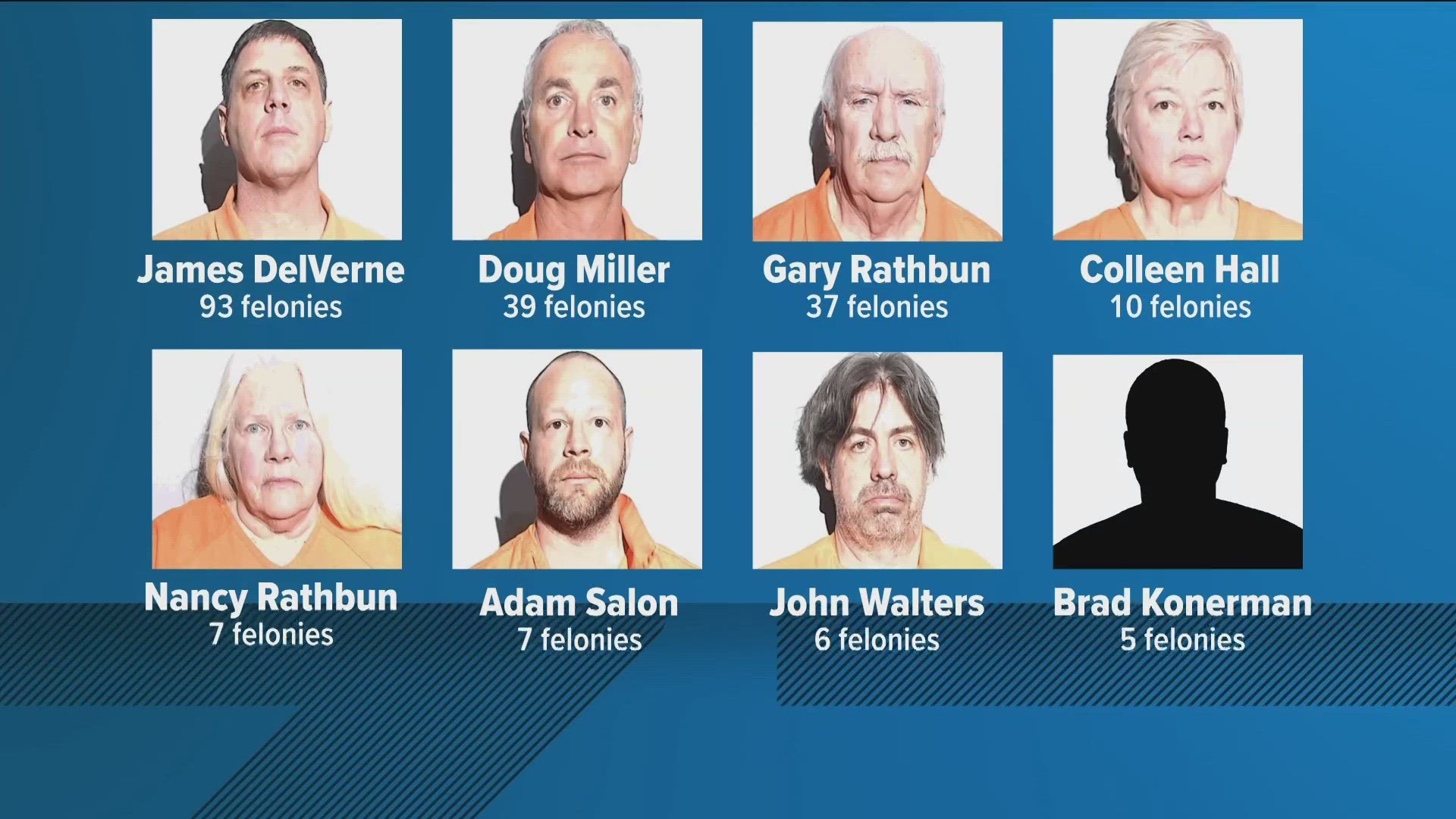

According to a press release issued by the Ohio Attorney General Tuesday afternoon, an indictment was filed last week in the Lucas County Common Pleas Court, naming eight defendants facing felonious charges:

- James DelVerne, 93 felonies

- Doug Miller, 39 felonies

- Gary Rathbun, 37 felonies

- Colleen Hall, 10 felonies

- Nancy Rathbun, seven felonies

- Adam Salon, seven felonies

- John Walters, six felonies

- Brad Konerman, five felonies

All defendants except Konerman are due in court Tuesday at 1 p.m. for arraignment. Konerman is due in court Wednesday at 1:30 p.m. for arraignment.

Some of the defendants also appeared in court Monday and had bonds set. Hall, Walters and Nancy Rathbun had bonds set at $50,000. Miller had bond set at $250,000.

According to the Northwest Capital website, DelVerne was the director of development, while Waters was the firm's chief credit officer and chief risk officer.

DelVerne managed relationships with private lenders and oversaw a purchase order funding group. Walters was responsible for identifying, quantifying and mitigating the credit and operational risks associated with commercial financing operations.

Salon worked as the director of football operations at Bowling Green State University from 2008-2009, and at the University of Toledo from 2011-2012. Konerman was the director of men's basketball operations at UT from 2008-2012.

Authorities said seven of the suspects were arrested Tuesday, while a final suspect is in the process of turning himself in.

The felony charges include engaging in a pattern of corrupt activity, unlawful securities practices, telecommunications fraud, aggravated theft, perjury, money laundering and several other financially-related charges.

The full indictment is included below:

Authorities said the alleged criminal activity took place between January 2011 and December 2021, during which the defendants advised clients to purchase investments without fully disclosing the managers' conflicts of interest.

They also allegedly manipulated funds to make investments appear successful, and are accused of creating new investment entities without disclosing the poor financial condition of the companies. The investment entities created by the managers also allegedly enabled them to "skim"' monitoring fees from clients.

In total, the suspects are accused of mismanaging a combined total of $72 million from 741 investments belonging to at least 200 people.

The Ohio Attorney General also said other investment entities are associated with the indictment. These include Briarfield Capital, ThunderRoad Partners, TRF Fund 1, TRF Fund 2, Kings Point Leasing and Winding Creek Partners.

Authorities described the indictments as the "culmination" of a multi-year investigation by the Ohio Department of Commerce's Division of Securities and the Ohio BCI.

In February 2021, WTOL 11 reported the Ohio BCI and the Department of Commerce executed a search warrant at a building on Kings Pointe Road in Sylvania with a Northwest Capital sign out front.

The Ohio Attorney General also said those who suspect they or a family member is a victim of investment fraud can call the Division of Securities' Investor Protection Hotline at 877-683-7841.

MORE LOCAL CRIME HEADLINES FROM WTOL 11