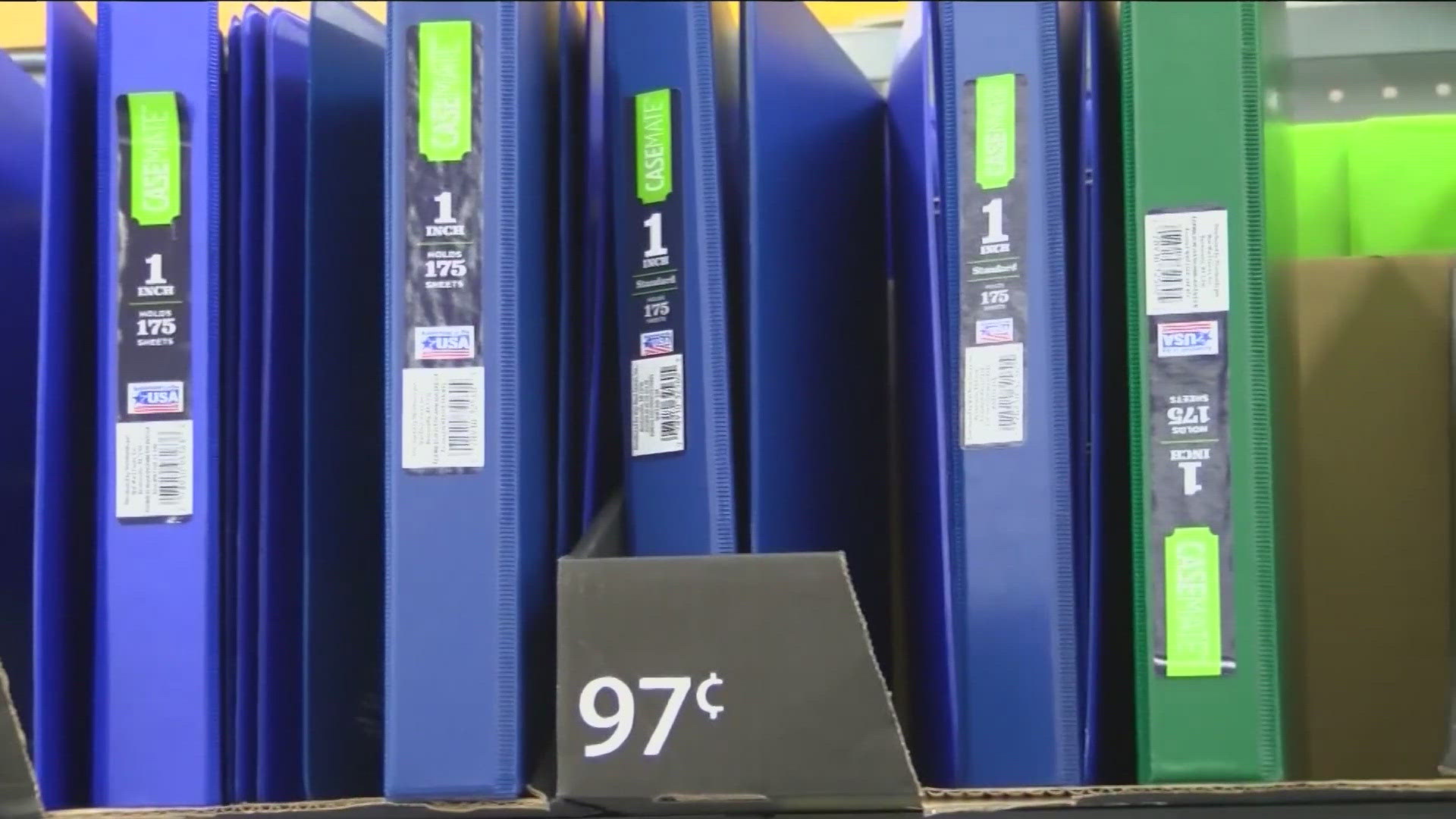

OHIO, USA — It’s time to save on Back To Class shopping and this year, the deals are going even further.

Instead of happening on a single weekend, the sales tax break has expanded to 10 days lasting from Tuesday, July 30 through Thursday, Aug. 8.

The sales tax holiday will include all tangible items up to $500, including clothes priced at $75 or less, school supplies that’s $20 or less and even “dine-in” restaurant food items, except for alcohol.

Each purchase made during this holiday, both online or in person, will be exempt from the state's 5.75% sales tax and any additional county or local sales taxes.

Below is a list of items that are NOT eligible for the 2024 tax exemption:

Watercraft and motor vehicles.

Tangible personal property over $500.

Cigarettes, alcoholic beverages, tobacco, vaping products, and items containing marijuana.

Taxable services like alterations on clothing, car repairs, or similar services.

Periodic payments that require multiple payments over time, even if the item is under $500.

Below is a list of sales tax rates by county:

Defiance – 1.00%

Fulton – 1.50%

Henry – 1.50%

Lucas – 1.50%

Ottawa – 1.25%

Sandusky – 1.50%

Seneca – 1.50%

Williams – 1.50%

Wood – 1.00%

Wyandot – 1.50%

To find more information about the sales tax holiday from the Ohio Department of Education, click HERE.

WATCH more on WTOL: