About to retire, she lost everything to the pig butcher's playbook | 11 Investigates

Investment scammers reaped a $6 million windfall from unsuspecting northwest Ohio victims. The FBI is warning residents of this cybersecurity threat.

“Hi, this is Vincent.”

A seemingly innocuous text on WeChat. Probably a mistake, but it still made Lynn curious.

She had no close friends by that name, but she did know her husband had a cousin named Vincent in another state.

She sent a reply back, and the beginning stages of a pig butchering scam took root.

By the time it was completed a month later, Lynn’s entire retirement nest egg – nearly $1 million – was gone.

“She’s worked very hard for over 40 years, about to retire. She lost everything, everything,” her husband, William, said. “She’s devastated. We are both devastated.”

The "Pig Butchering Scam" A financial slaughterhouse

Pig butchering scams originated years ago in the Far East.

In 2022, ProPublica published an investigation that showed Chinese crime syndicates were using human trafficking victims from China, Thailand, Cambodia and Vietnam to pull off the scam. Rather than a hog being fattened for slaughter, scammers emotionally fatten up their victims – by building a personal relationship, earning their trust, introducing them to lucrative investment opportunities - then financially slaughtering them.

“They usually contact individuals through dating apps, social media sites, sometimes text messages or phone,” FBI Special Agent Matt Swansinger said. “Over time, what happens is you build this relationship, then here comes the investment pitch. And that investment pitch is usually, ‘I’ve got relatives who invest in cryptocurrency’ or ‘I know somebody who invests in cryptocurrency and has a way to make money quick.’”

According to data that the FBI provided to 11 Investigates, Americans lost $4 billion in investment scams in 2023. The FBI told our 11 Investigates team that the total increased more than 50 percent last year compared to 2022.

The introduction to the scammer happens when the victim responds to a text, a friend request, a direct message on a social media app or even a direct phone call.

Ever received a phone call or text where the person says, “Hi, is this Jim? … or Jane? ... or Bill?”

That could be someone trying to get you to respond.

In the pig butchering scenario, the scammer has already done their homework, possibly looked at your public social media posts.

“If you have hobbies or any kind of interests that are out there (on social media), they may use that as a hook to get into you," Swansinger said. "That’s how they end up building the rapport and that friendship with you, and that’s when they will make the pitch for the investment."

It is not a week-long process. In researching and talking to people for this story, there have been instances of a scammer developing a relationship for months before pitching the investment opportunity.

A common pitch is in cryptocurrency, something the average person isn’t too familiar with. But the scammer will carefully walk the victim through the steps and show them trading boards – some real, some fake.

An effective tactic in the pig butchering scam is that the scammer will initially ask for a small amount of money - $1,000, for example – then wire it back to you, with significant gains. This is real money that lands in the victim’s bank account and can be withdrawn.

But then it escalates, “Look at all the money you made with that small amount. Imagine if you gave more.”

Gary Harden, a local transactional tax attorney, has worked with three people victimized in northwest Ohio. Their total losses amount to close to $6 million. He is involved because there are tax implications when a person cashes out an IRA or 401(k).

“They were all intelligent people. One was a doctor, one a lawyer, another an educator," Harden said. "So they’re all well-educated, and yet somehow, rather surprisingly, they fell victim to this scam.”

Life savings "down the toilet" The pig butchering playbook

In developing a relationship with Lynn, Vincent followed the pig butchering playbook.

“He pops out of the blue one day on my wife’s messaging service and pretended that he reached her by mistake. He said, ‘Oh, I’m so sorry,’ but then he began to engage very benignly," William said. "He very innocently engaged in chit-chat with my wife and started to ingratiate himself with her little by little."

William and Lynn are not the couple’s real names. The only way that William would talk with us was if we would disguise his identity, but he provided significant documentation of transactions, photos, and messaging. He also provided a copy of their report to the FBI. His story has been corroborated by Harden, the tax attorney.

Lynn was too embarrassed to talk about the experience, but her conversations with Vincent went on for about three weeks.

“At some point, he says that 'my family owns a hotel company, but I dabble in investments, and I have a group that buys and sells gold,'” William said.

Lynn was sent a picture of a hotel sign and phone number. 11 Investigates looked into the hotel. The phone number was invalid and the hotel was located in a crime-ridden section of Los Angeles, with nightly rates of $70; not anything close to what Vincent was describing.

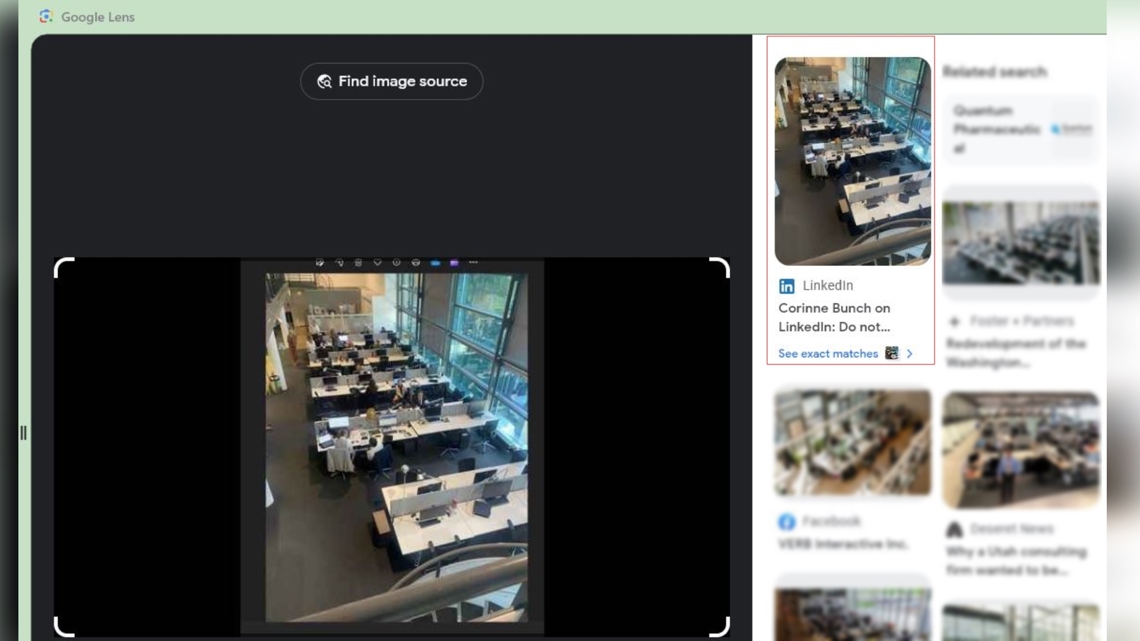

In addition, he sent a photo of his “workers” busily making trades on the gold market.

A reverse image search uncovered that it was a stock image found on LinkedIn.

A profile picture of Vincent that he sent Lynn was found in a promo photo from a Chinese DVD collection.

Most appealingly, he sent a screenshot of her apparent trades listed on a realistic-looking trading site. It was likely created by Vincent’s team.

At one point, a shot indicated that Lynn’s investments had grown to more than $4 million.

“In the beginning, he suggested a relatively small amount of $10,000 to invest,” William said. “He said, ‘I’ll make some money and send it back to you with the profit.”

And he did. The money was wired to her account.

"He said, 'Look how much money you made with this little amount. If you invest more with me, I’ll make you a lot of money. The more the better,'" William said. "That’s how it progressed."

Wire transfers by Lynn to a New York bank that were shown to 11 Investigates were as high as $200,000 and $370,000 as she drained IRAs and savings.

“It put a huge strain on our relationship because I didn’t know where this was going. She got understandably frustrated and angry with me every time I would express my concerns or criticisms,” William said. “I could hardly sleep. We would get in big fights over this.”

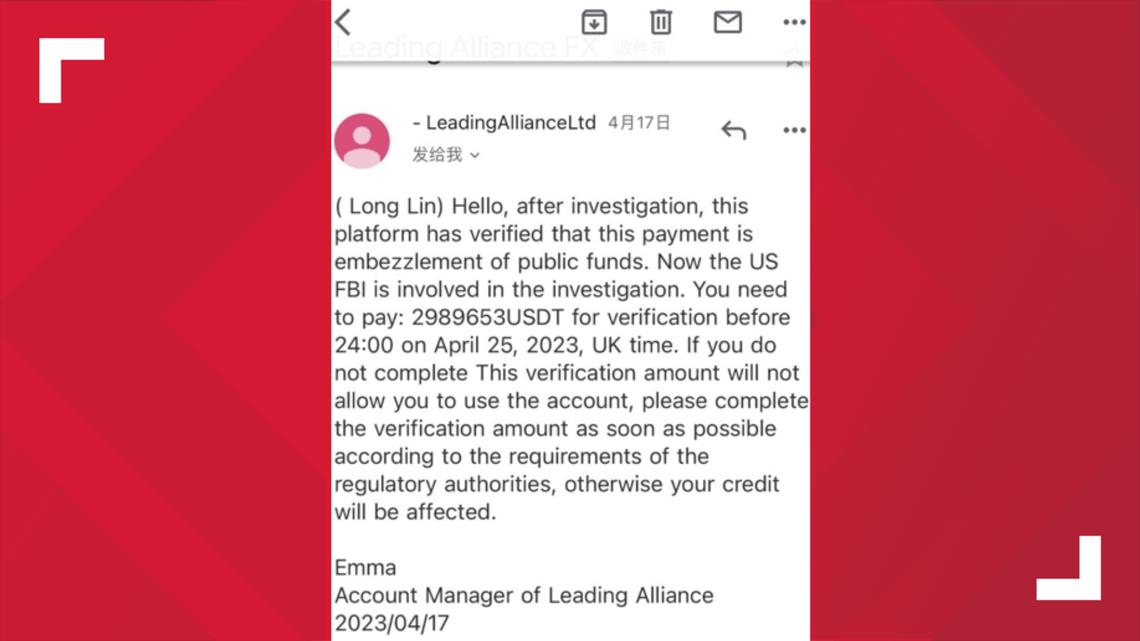

Then as Lynn told Vincent that she was running out of money, she received an urgent alert from Leading Alliance LTD, saying that the money was locked up and the FBI was now involved, so she would need to pay nearly $3 million to unlock it.

Because he liked her so much, Vincent said he would pay at least half of it.

And he had suggestions for her on how to replenish her money.

"He said, 'Well, you could sell your house. You can go to the bank and get a loan. You can go to a loan shark,'" William said. "He actually told us to go to a loan shark."

By now, William was done.

“One night we stood in the kitchen and she expressed a frantic need to get $500,000 to unlock the account. I said no,” William said. “To her credit, she realized it was gone. She realized at that moment that it was just a scam.”

Vincent had a parting message for her when she said she had no more money to give:

“When he realized he was not going to get any more, he said, ‘oh well, I admit it. You stupid, fat cow. I’ve got your money. Good riddance.’”

Don't be a victim FBI warns of what to watch for

Besides being a financially devastating event, a successful scam can also have a severe emotional impact. Unfortunately, some victims are too embarrassed to come forward to the FBI, so the $4 billion in losses figure that the FBI provided us is likely an underestimate.

“We ask that if you don’t want to come forward, you could find a family friend or family member to advocate for you and at least report it to us. We do want to know about it,” Swansinger said. “These guys, unfortunately, are good at what they do and they trick a lot of people into sending them money.”

The agency has a cyber crime unit and collects complaints at ic3.gov. Other information can be found at fbi.gov. According to Swansinger, some wire transfers can be stopped if the scam is reported within 24 to 48 hours.

If the scammer convinces you to deal in cryptocurrency or to go to a Bitcoin ATM, there is little that can be done to recover that money. But he said it’s important that people report it to the local FBI office or at ic3.gov.

“We ask that if you are a victim, that you provide as many details and information as possible. That would entail the individual’s name, whether it’s on the phone, text, messaging, chats, email addresses," Swansinger said. "If they provided you any cryptocurrency alphanumeric number, or QR code that you sent the cryptocurrency to, send that to us.”

He said a prime target for scammers is those between the ages of 30 and 49 years old because that age group is active on social media and has access to financial resources. But he added that people who are widowed or single are also attractive targets because of their desire for friendships.

“Before you click on a hyperlink from somebody or a text message from someone you don’t know or a social media message where someone tries to friend you, ask yourself: Do you know that person? Do you recognize this person? If you don’t, delete it, leave it alone, or don’t respond,” Swansinger said. “If you don’t recognize that number, don’t answer it. Let it go to voicemail. Eventually, they’ll move on and find someone else to take their phone call.”

In Harden’s case, he said people should know that those who are scammed are eligible for tax deductions, which is how he gets involved, but it’s important that victims keep good paperwork.

"But my message is to be careful when you’re on the Internet," Harden said. "Understand that someone could be profiling you, setting you up for a big loss."

Rebuilding and moving on Dreams and hopes gone to criminals

For William and Lynn, they are fortunate that the couple kept their savings and retirement accounts separate. William was able to move money into Lynn’s IRAs to prevent severe tax penalties.

"I have a little bit of savings. We can live on that, but many of our dreams and hopes – things we were wanting to do – are gone, torn up," William said. "I would have preferred to take this money and put it in a trash can than to see it go to these criminals."

The couple is working with Harden, but the financial implications will probably go on for years.

"I’m furious, mad, angry," William said. "I think it might be the same feeling as if someone breaks into your house and violates you or violates your house. You think your house is safe or sacred. It’s the same sort of feeling."

He repeated the same advice as Harden and Swansinger: Be careful on the Internet. Don’t engage with people you don’t know. If someone approaches you, let others know.

"If you want to destroy your life and be devastated, then don’t listen to the advice I just gave you. If you don’t want to be devastated, don’t want to be destroyed, don’t want to see your life savings go down the toilet, don’t engage with these people," William said. "But if you do, tell everyone. Tell your family so that you won’t be destroyed like we were."

MORE FROM 11 INVESTIGATES: