TOLEDO, Ohio — There’s a sadness that hangs in the air while listening to Craig Kirkendall on his Liberty Street porch.

It’s not because of the manic depression, bipolar disorder, and heart failure issues that he freely discusses. There’s a sense of loss and frustration that runs through his conversation.

In March, 2010, he stopped by to visit his father at his Toledo home on Liberty.

It was a chance to catch up. Instead, he found his father dead in a living room chair.

“I was the one that found him, and it was really traumatic. He was my best friend, not just my dad.”

The home was paid off. But Kirkendall had to decide if he was meant to be a homeowner. He decided he did not want to lose the memories, so he kept his childhood home.

“I wanted to have this house to cling to, and then, you know, I thought I might eventually be able to sell it.”

It was the start of a financial nightmare. Bills, including bills for repairs to the home, began piling up. He got a real estate tax bill for $700.

“I didn’t know that was a thing,” he said. “That’s a lot of money. I was working at Kroger.”

At some point, Craig’s home became part of the 11 percent of Lucas County properties that are delinquent. By comparison, Fulton County’s rate is less than 1 percent.

“It’s never fun owing people money and always being in the red.

A growing problem

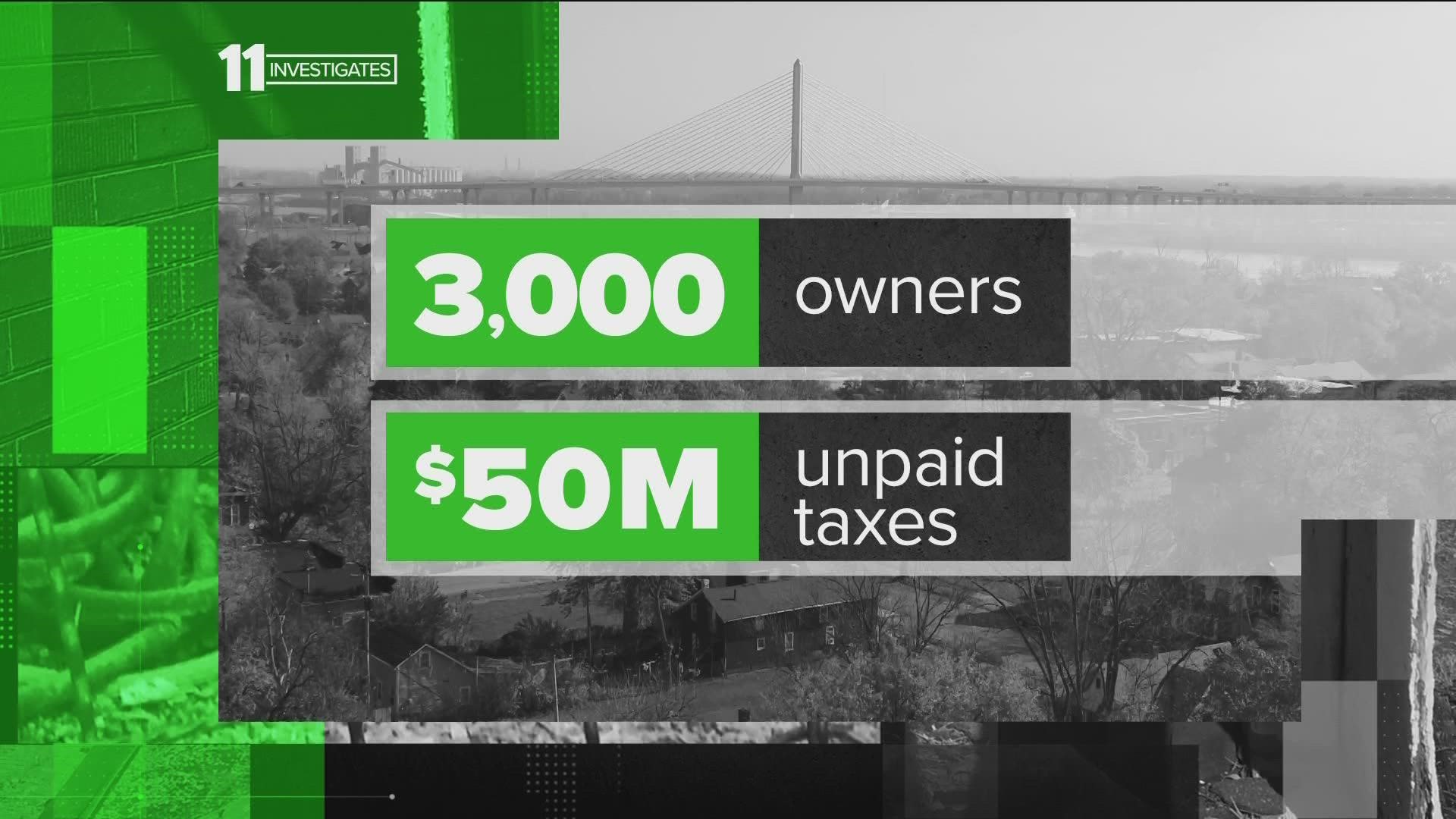

For nearly five months, 11 Investigates looked through county tax records. There were 14,460 properties that were delinquent at the end of 2021, owing a total of $52 million. The top 3,000 delinquent properties in Toledo account for more than $50 million in taxes owed. And the issue is getting worse, taking away potential money for essential services in the city.

“Through a series of strategic efforts, we try to collect as much money as we have with the resources we have. But the number grows because it is compounding,” Lucas County Treasurer Lindsay Webb said.

For those like Kirkendall, it’s almost impossible to catch up while trying to pay for life’s basic necessities. And Webb is sympathetic to the issue.

“Everyone knows that poverty is an issue in Toledo. Twenty-five percent of families live in poverty, and some of those people are homeowners,” Webb said. “My office does absolutely everything that we can do to work with those people and get them on payment plans.”

But the issue doesn’t just involve the poor. We discovered properties owned by LLCs and wealthy landlords are also delinquent.

In an advertisement, Babich Properties touts that it buys homes in any condition and then re-sells them, leases them or offers them as rentals. It owns nine properties in the county. Six of those are delinquent on taxes. A home on Shady Drive, which recently sold for $12,000, has a tax bill of more than $6,000.

11 Investigates tried to reach the owner of the LLC at his home but was unsuccessful. A representative of the company did, however, exchange texts with us, saying that the LLC will be current on taxes within two weeks. It currently owes $31,115.

The representative said the pandemic prevented some tenants who lost jobs from making rent payments, which made it impossible for the owner to pay the taxes.

But all six delinquent Babich properties went into delinquency well before the start of the pandemic. However, there has been recent progress, with payments of more than $1,000 made on each property in January.

The county will never be able to collect from the third category of delinquent property owners – the deceased.

During our review of records, we discovered that there were 497 dead residents still on the delinquent tax rolls, all of them still accruing penalties and interest. In one case, a Toronto Avenue man died in 2010, yet his property now owes more than $33,000 in real estate taxes.

Frustration from the county

In some instances, house-flippers simply pass along their tax debt.

Early in our interview, a frustrated Webb alluded to the problem, saying that wealthy property owners will gobble up cheap, neglected homes in the central city. They then fix them up and sell them without ever paying real estate taxes on the property.

“In Michigan, if you want to sell your property, you have to be current on your property taxes. In Ohio, that is not the case. And so people are shocked. Sometimes people buy properties, and then they find out that it has a very sizable tax debt, and they’re now responsible for it.”

Solutions for the problem

While the outstanding tax debt continues to grow, Webb said she is aggressively addressing it. In some cases, she utilizes foreclosures, but she said it doesn’t need to get to that point.

“There is money in our community right now because of federal funding to help people," Webb said. "If people know about it, they’re not taking advantage of it. There are other resources, primarily through the auditor’s office, like homestead exemptions, owner occupancy credits, other things people might not be aware of. When they come and talk with us and try to work with us, these are things that we can share with them to help lessen the burden.”

When it comes to the issue of conveyance of deeds without the tax bill being settled, Webb said counties need help from the General Assembly.

“I think there should be a requirement that property taxes be paid upon the transfer of a deed,” she said.

So we asked what more could be done, and that led us to state Rep. Derek Merrin, R-Monclova, who chairs the Ohio House’s Ways and Means committee. He told us he is willing to look into the issue.

“I have not heard of this issue. Lindsay hasn’t spoken to me about it," he said. "There’s not a bill in the legislature right now, regarding prohibiting the conveyance of property if back taxes exist. I’m certainly willing to explore that.”

For Kirkendall, home ownership and its responsibilities were not the right choice.

“It was an emotional decision," he said. "And it should have been more practical.”

He’s not joking when he said a possible solution is to give a home ownership competency test.

“I would have failed. And then I would have said, ‘I’m probably better off staying in my apartment.”

* If you have questions about your real estate taxes, you can call 419-213-4305.

If you would like to be put on a payment plan for your real estate taxes, you can call 419-213-4055.

More on WTOL: