TOLEDO, Ohio — A local business is out $27,000 after the owners put their trust and their money in the United States Postal Service and in their federally-backed bank, which hasn't returned the money that was stolen from them.

So, the small business owners came to Call 11 for Action for help.

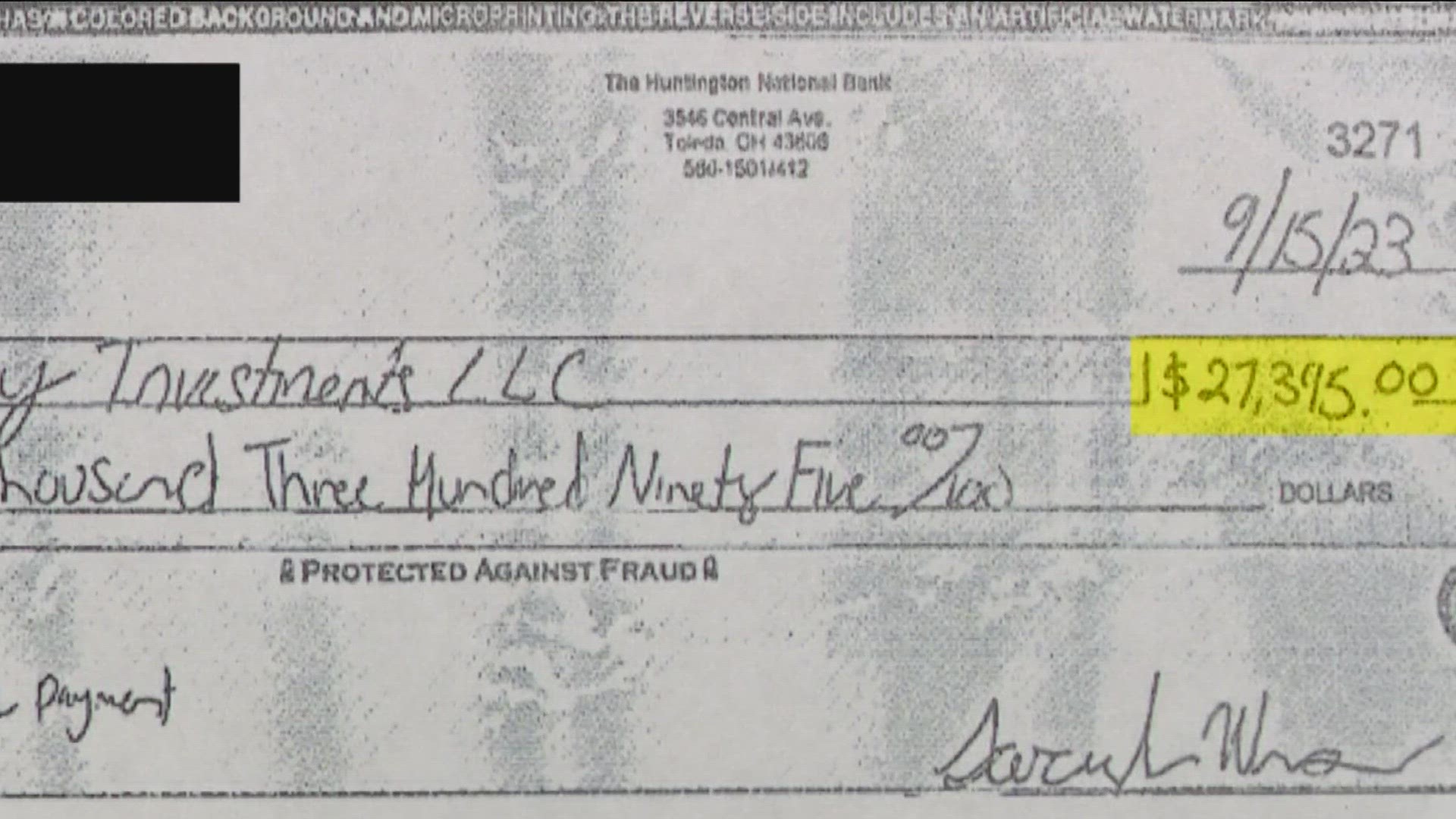

Jeremy Wiswell said he and his wife, Sarah, had a check written to a vendor for $395 in September. Sarah checked their account the next morning and found that the check had been compromised and written for $27.395.

They immediately noticed how the check's border looked different, Jeremy said.

Their check fraud nightmare started the same way many others have in our area. It was stolen from a USPS mailbox they deposited it in, this time by the Central Avenue and Goddard Road intersection.

Unlike many of the check fraud schemes, this one wasn't washed. The crooks appear to have simply taken the business name, address, routing and bank account number and put it on another, separate check.

In several cases Call 11 for Action has reported on, the fraud victims were reimbursed by their bank. But not the Wiswells, who are still out $27,000.

"I'd like for everybody to understand and know that you feel secure, like that it's federally-insured funds, but it's really not and then you sign up for these programs they lead you to believe they're going to be more secure," Jeremy said.

The Wiswells pay $25 a month for an added protection service called Reverse Positive Pay through Huntington Bank.

They have seven hours to approve checks before they're processed using a key fob, which provides a one-time authentication code.

"If you miss the opportunity to check on those checks within that seven-hour window, those checks will process," Jeremy said.

Coincidentally, Sarah had left that key fob at home the very day that the $27,000 fraud check was posted. They also say they were not told by Huntington Bank that they could also use Reverse Positive Pay on an app, which Sarah could have done without the key fob.

The Wiswells feel the very service they purchased to protect them is what put the liability on them and not on Huntington Bank.

"All it does, from what I can tell, is relieve the banks of any liability," Jeremy said.

WTOL 11 reached out to Huntington and received this statement from Tracy Pesho, senior vice president, communications director, business segments & external relations:

At Huntington, we are committed to doing the right thing for our customers, our colleagues, and for the communities we serve. For privacy reasons, we are unable to comment on individual customers or their accounts.

Call 11 for Action also notified the Wiswells that the stolen check should be reported to the United States Postal Inspector and checks should be taken inside post office locations to drop off, as recommended by the USPS.

Huntington also shared these tips with WTOL 11 on ways to avoid becoming a victim of check washing:

- Consider making electronic or mobile payments.

- Use indelible black ink when writing paper checks.

- Follow up with recipients to ensure they received your check.

- Use online banking to view copies of your checks to ensure they were not altered.

- Do not leave blank spaces in the payee or amount lines of checks you write.

We recommend you immediately contact your bank if you believe you have been a victim of check washing.

Contact Call 11 for Action at 11investigates@wtol.com.

Editor's note: This story has been updated to add a statement from Huntington Bank.