TOLEDO, Ohio — The real estate market has been volatile during the COVID-19 pandemic - especially for those looking to purchase a home - and realtors say those conditions will likely remain through 2022.

Demand continues to outweigh supply as baby boomers and Gen Xers look to sell and then buy. Record-low interest rates also allowed millennials to enter the market over the past couple years.

Eddie Campos, a realtor with Re/Max Preferred Associates, said those are some of the factors jacking up home prices and making inventory scarce.

"Compared to a year ago, it's gotten even worse," Campos said. "It's definitely a situation where multiple offers are the norm, whereas in the past it would occasionally happen. Clients are now offering terms to the seller of no home inspection, appraisal gap fees, waiving the appraisal, cash offers. Things we don't normally see became the norm."

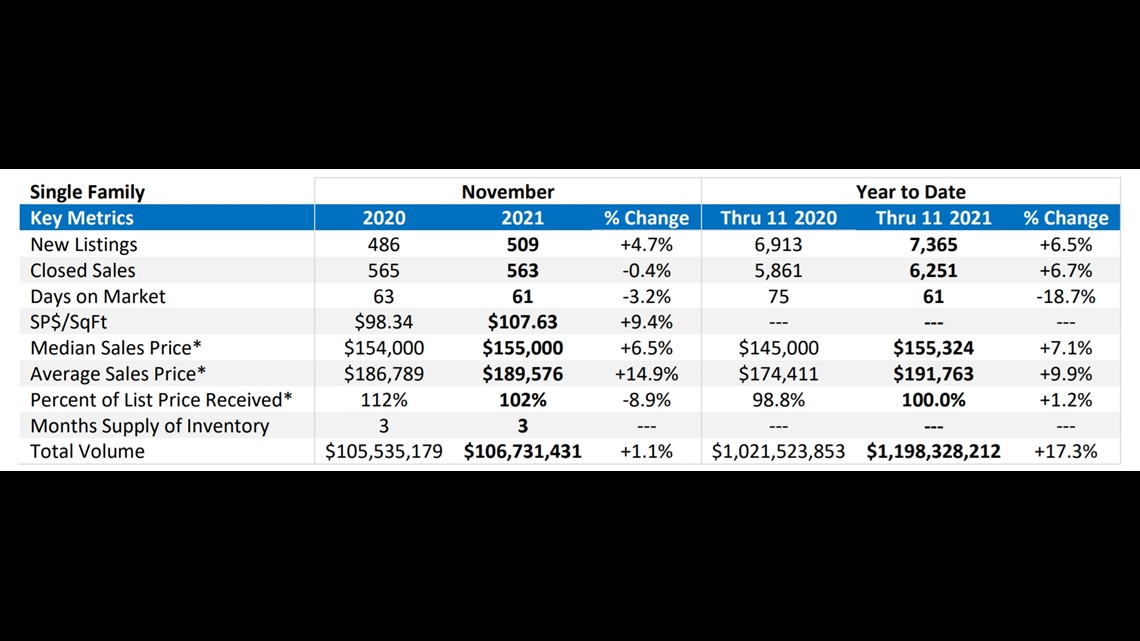

According to Northwest Ohio Realtors, the median sales price for a home in Lucas and Wood counties jumped to $155,324 in November 2021, just over $10,000 more than a year ago. The average sales price increased by more than $17,000 to $191,763.

December numbers are not yet available.

Realtor Tony Bassett, of Danberry Co., had a busy 2021 and closed over 80 deals. He said he averaged about 60 pre-pandemic.

While many buyers have been in the market for a year or more, Bassett said they should stay the course and take advantage of interest rates while they remain low.

"I fully expect prices to stay strong and inventory is probably going to stay low," Bassett said. "With rates so cheap, you're going to get a 30-year mortgage at 3%, maybe even 2.75%. That's incredible buying power. You've got three times the buying power I had when I was in my 20s."

Interest rates have been historically low for years, but experts believe they'll start to climb in 2022.

At the end of 2021, the average rate for a 30-year mortgage was 3.69%. However the Federal Reserve hinted in December that up to three rate hikes could be coming in 2022 as the economy continues to stabilize.

Bassett said it's still possible to navigate these tricky real estate waters, especially if you have a reliable and experienced agent.

"Get in touch with a good realtor who is full-time and has their finger on the pulse of this market and pays attention," he said. "Not only on-market, but off-market. You've got to think outside the box. But it's still a great time to buy. If I were a buyer, I wouldn't wait a year because 3% might turn into 5%."

Campos said homes that appear to be in perfect shape with modern features like white cabinets, granite countertops and updated décor are likely going to sell fast and above list price. However there are still good homes to be had.

"If you're a buyer and you think you don't need all those things or you don't need them all right now, there are opportunities to find a home you could possibly still get at list price," he said. "Maybe even a small discount and get your closing costs paid for."

Many homeowners are ready to sell, but hesitant to put their home on the market out of fear they won't be able to purchase another one fast enough. Campos said it's a good idea to contact your lender and ask about borrowing against your home equity to purchase a new home first, then sell your existing house.