GIBSONBURG, Ohio — Voters in Gibsonburg will decide in the Nov. 8 election on a crucial source of revenue for their local school district.

In 2017, Gibsonburg School District voters approved an increase to their 0.75 percent earned income tax up to a full 1 percent.

The revenue from that tax brings in more than 10 percent of the the district's annual budget.

The tax is set to expire at the end of 2023 and the district is asking voters to approve the 1 percent tax for another five years.

"It works well for us because we are avoiding land tax, avoiding property tax, avoiding investment or rental income. So it really is just on the money that our residents are earning," Superintendent Bob Falkenstein said. "This income tax is also only earned income. So it does not impact property tax or the fixed incomes of retirees. This is only on money being earned in the district or by district residents"

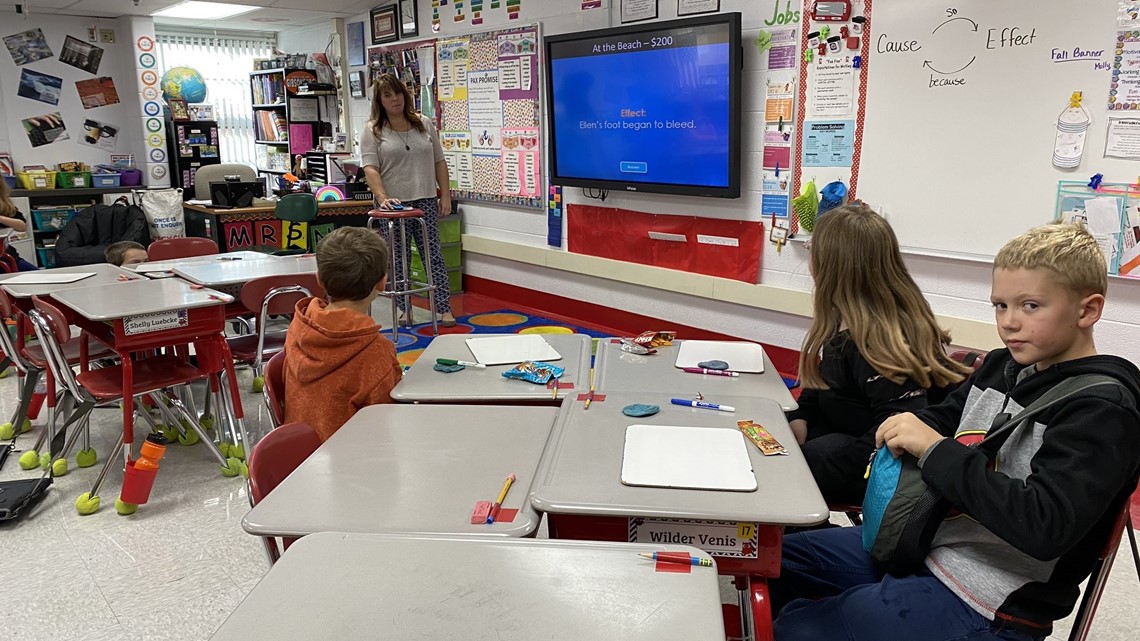

Like many rural districts, enrollment at Gibsonburg Schools has declined slightly over the years. Educators say despite that they want to ensure quality education and engagement for students.

"It just allows us to do the things we need to do to support our kids. Because they are coming with more and more needs, and those needs we couldn't possibly take care of appropriately without that extra income," Hilfiker Elementary Principal Emily Sisco said.

"And be here to really serve our students, we want to keep a student focus at Gibsonburg schools," Falkenstein said.

The group Citizens for Better Schools will be on site at this Friday's Gibsonburg home football game with information and can answer any questions about the income-tax levy.

More on WTOL: