WASHINGTON — The Verify team is here to make sure you don’t give up any personal info to any bad actors, and with stimulus checks and tax season amongst us, new scams have popped up.

So let's Verify:

QUESTION:

Will the IRS ever send you an email about your tax return?

ANSWER:

No. The IRS will not send out an email asking for any personal info. You shouldn't open any unsolicited emails that claim to be from the agency.

SOURCE:

- March 30 scam warning from The Internal Revenue Service (IRS)

PROCESS:

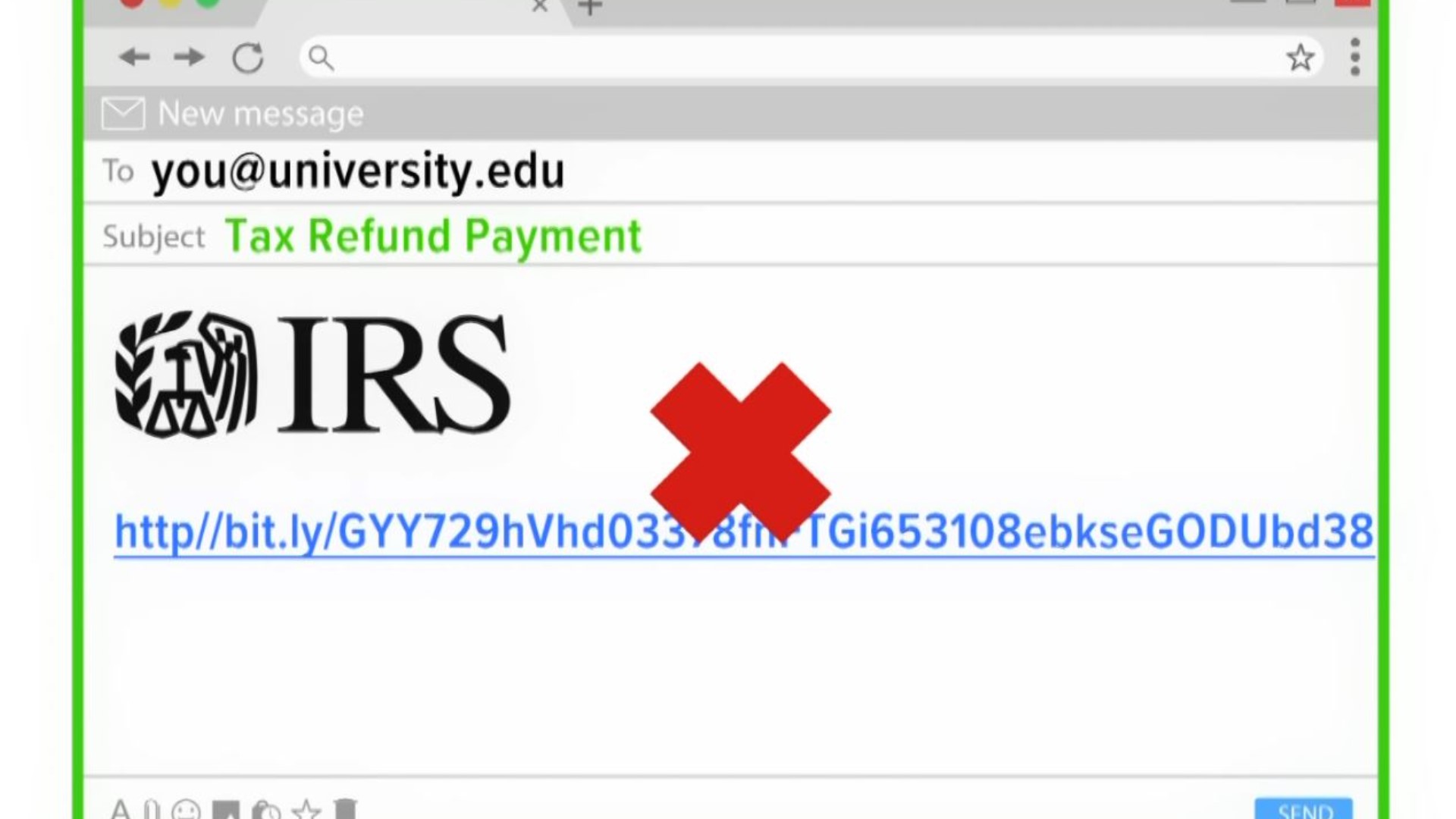

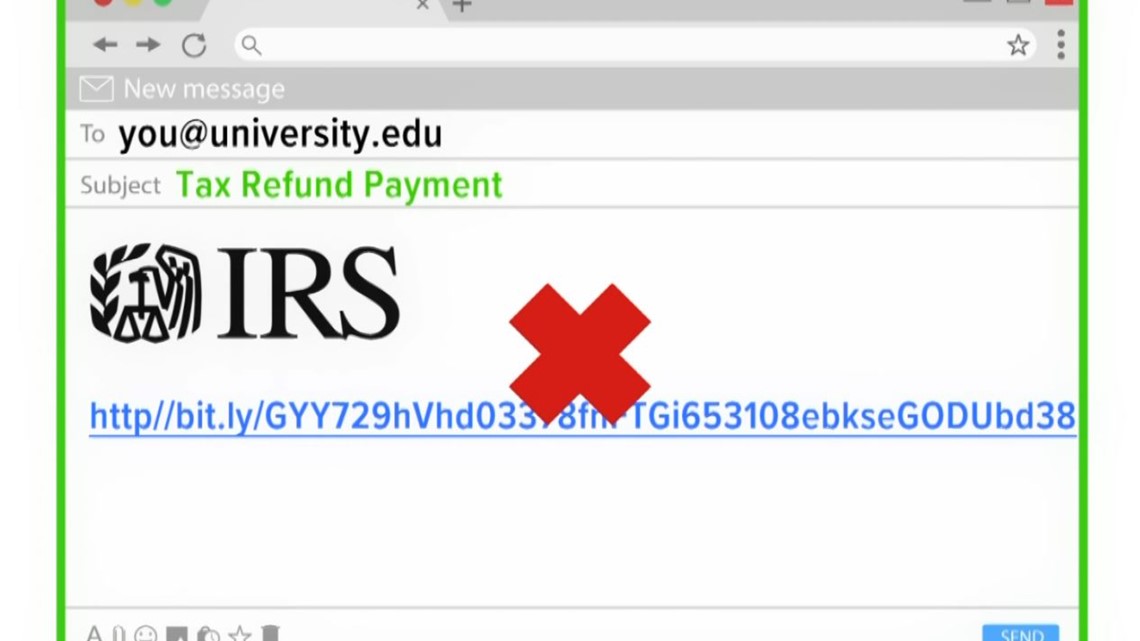

The IRS is warning people about a new "impersonation email scam" going around online, specifically targetting college students and those with .edu and university email addresses.

Look out for an email with an IRS logo and a subject line that says something like "Tax Refund Payment." That fake email will ask you to click a link and fill out a form, which in turn asks for personal info like your Social Security number.

To get more answers on how to spot this scam and stay safe, the Verify team went straight to the IRS.

Most of the time, the IRS initiates contact through regular mail service that's delivered by the US Postal Service. They almost never email you, and would never ask for any personal or sensitive information online.

" As a general rule, we do not use email to contact people about their tax returns," a spokesperson for the agency told Verify. "Unsolicited emails should be considered a scam."

The agency continued that in regards to tax returns, you would have to have already entered your Social Security number or some form of federal ID when filing, so there is no reason for them not to already have it.

"You can’t file a return without an SSN or some other kind of federal identification number, so logically, we would have no reason to contact you for this kind of information," the agency said. "We would already have it because you already provided it when you filed. That’s why any request of this kind should be assumed to be a scam."

People do have the voluntary option to include a phone number or email address when they file their return for any follow-up needs, as listed in the IRS's instructions to the 1040 form. But they wouldn't ask for any of your personal information only over email.

"But if you didn’t do that on your return, we would not be contacting you that way," the agency wrote, adding that the Treasury Inspector General for Tax Administration (TIGTA) and IRS Criminal Investigation have already been notified of the phishing attempt.

If you think you have seen this email before, you can report it to the IRS directly. For security reasons, save the email using "save as" and then send that attachment to phishing@irs.gov or forward the email as an attachment to phishing@irs.gov.

So we can Verify that if you see an email like this, either delete it or send it to the IRS.