TOLEDO, Ohio — Jeremy Wiswell thought his small Toledo business would be safer from fraud if he purchased additional protection through his bank. He paid $25 per month for a fraud-protection service called Reverse Positive Pay.

"You sign up for these programs and they lead you to believe they're going to be more secure," Jeremy Wiswell said. "All it does, is from what I can tell, is relieve the banks of any liability."

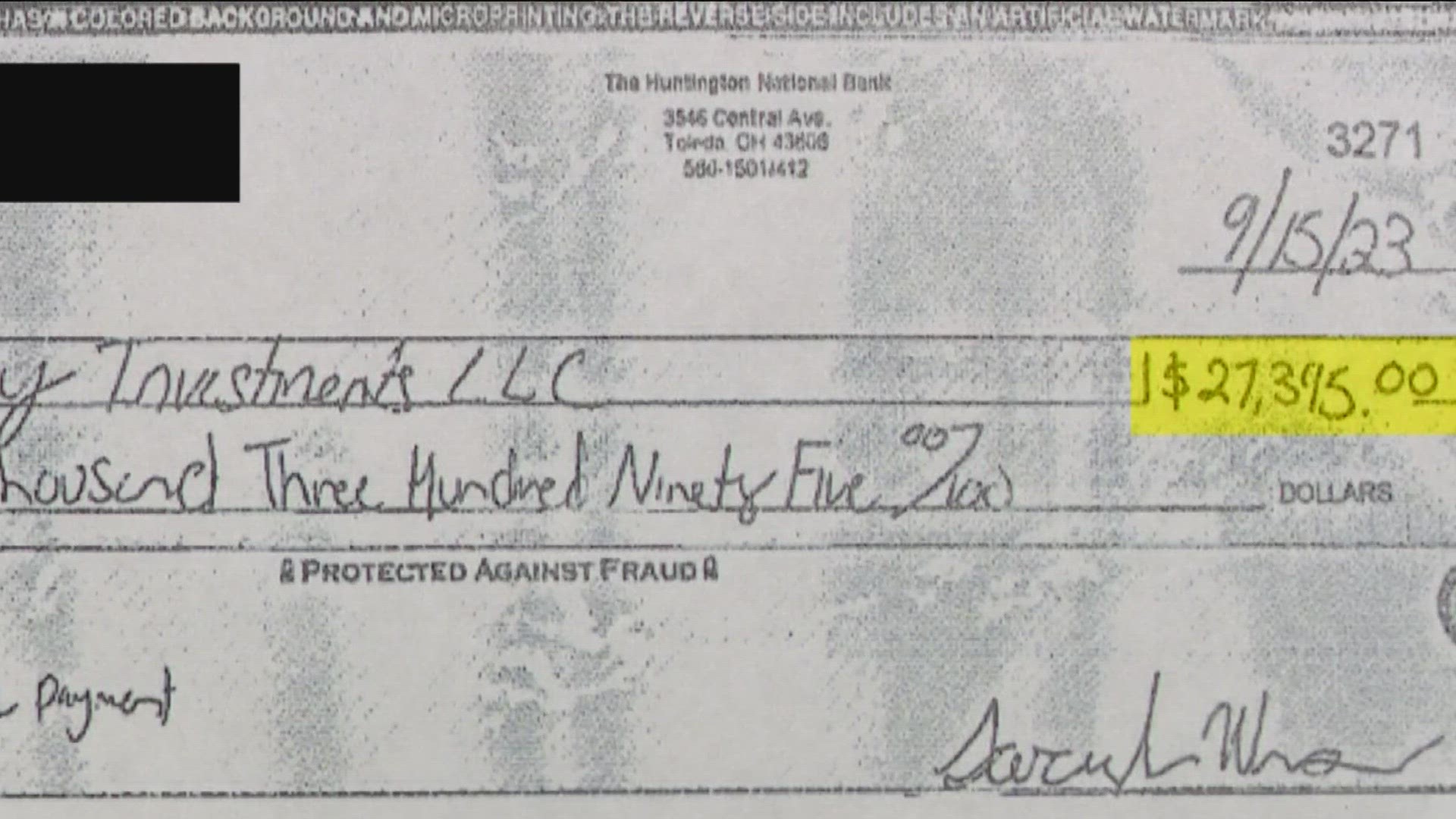

Last September, the key fob needed to access the business account and approve or reject the checks presented for payment was left at home, Jeremy Wiswell said. The key fob receives a one-time authentication code needed to access the account. On that day, a check that was sent out for $345 was cleared for $27,345, leaving his business out $27,000.

It all started when his wife Sarah Wiswell, who handles the accounting at the business, deposited the check in a blue United States Postal Service mailbox on Central Avenue. The check was stolen and the information on the check was copied. It was then written and deposited to an LLC in Columbus, according to the Wiswells.

Nearly four months later, they have not been reimbursed by their FDIC-insured bank.

Reverse Positive Pay is offered by various banks. It gives consumers a limited time to review checks and verify whether they are legitimate before they are processed for payment. Jeremy Wiswell said the services gives him a seven-hour window to authorize or reject the payments.

The Wiswells admitted they missed that seven-hour window but did not realize it could mean their money was gone, especially since they have fraud protection with Reverse Positive Pay.

"So, you're paying for it and it makes you less secure," Jeremy Wiswell said.

Toledo bankruptcy attorney Scott Ciolek said that when banks sell you these products, you are essentially paying them for you to do the work and for you to hold liability for spotting fraud, which is the banks' responsibility.

"I would not advise anyone to get the Reverse Positive Pay," Ciolek said. "The banks take a service that they're already supposed to be performing, which is the review and the verification of the checks, outsourcing it to their end user and then charging the service for the fee."

Ciolek said consumers generally have 30 days to alert a bank of fraud in order to be protected.

"You're basically compressing that 30-day window when you sign up for Reverse Positive Pay to seven hours," Ciolek said. "Sometimes it's misleading and it gives you the impression you're gonna be covered when you're in fact not."

In this case, Ciolek said it will be a lot of paperwork, phone calls and emails, but the Wiswells should get their money back.

He pointed out that the Wiswells' bank knows there has been fraud and the bank where the check was deposited told the Wiswells that it froze the funds on suspicion of fraud, which means the funds are still available.

Ciolek also said the bank's liability may kick in again if it does nothing to return those funds to the Wiswells.

"They have a new duty to their account holder that goes beyond the Reverse Positive Pay waiver," Ciolek said. "They've been told that there's money down there (in Columbus) that's from a forgery that they need to inform Bank of America so they should do that as soon as possible."

Consumers should read the fine print on any agreements and ask themselves: "Does this agreement make you more liable if anything should happen?"

It could save a lot of trouble and even save your entire business.

"Most people are just one or two mistakes away from major trouble like this," said Ciolek. "Something like this could take a small business down quickly."

MORE FROM CALL 11 FOR ACTION: